Pet Insurance: A Financial Shield for the Maine Coon’s Unique Health Risks#

Owning a Maine Coon is a commitment to a magnificent and generally robust companion, but it is also an acceptance of the breed’s well-documented genetic predispositions. For these gentle giants, routine veterinary care is compounded by the high probability of managing chronic conditions that require specialist intervention, advanced diagnostics, and long-term medication. These costs—spanning cardiac screening, orthopedic surgery, and lifelong drug therapy—can quickly accumulate into tens of thousands of dollars. Pet insurance, therefore, shifts from being an optional luxury to a critical financial component of responsible Maine Coon ownership.

This guide focuses on why pet insurance is indispensable for this breed and the crucial factors to consider when selecting a plan.

1. Why Pet Insurance is Non-Negotiable for Maine Coons#

The urgency for pet insurance stems directly from the breed’s known, high-cost health issues:

A. Hypertrophic Cardiomyopathy (HCM)#

HCM is the most common cardiac disease in cats, and the Maine Coon is genetically predisposed (due to the A31P mutation).

- Cost Factor: Annual or bi-annual echocardiograms (cardiac ultrasounds), which are essential for monitoring the disease (as detailed in Hypertrophic Cardiomyopathy (HCM): Understanding the Maine Coon’s Genetic Heart Risk), can cost $500-$1,000 per visit. Lifelong medications (e.g., blood thinners, beta-blockers) are an ongoing expense.

B. Orthopedic Challenges#

The sheer size and prolonged growth period of the Maine Coon increase the risk of conditions like Hip Dysplasia and Slipped Capital Femoral Epiphysis (SCFE).

- Cost Factor: Diagnosis requires multiple radiographs (X-rays) and specialist consultation. Corrective surgery (like Femoral Head Ostectomy or Total Hip Replacement) can easily exceed $5,000 to $10,000 per affected joint (a risk highlighted in The Hip Dysplasia Paradox: Prevention, Diagnosis, and Management in Maine Coons).

2. Pre-Existing Conditions and Early Enrollment#

The most critical rule in pet insurance is the exclusion of pre-existing conditions. This makes the timing of enrollment vital for Maine Coon owners.

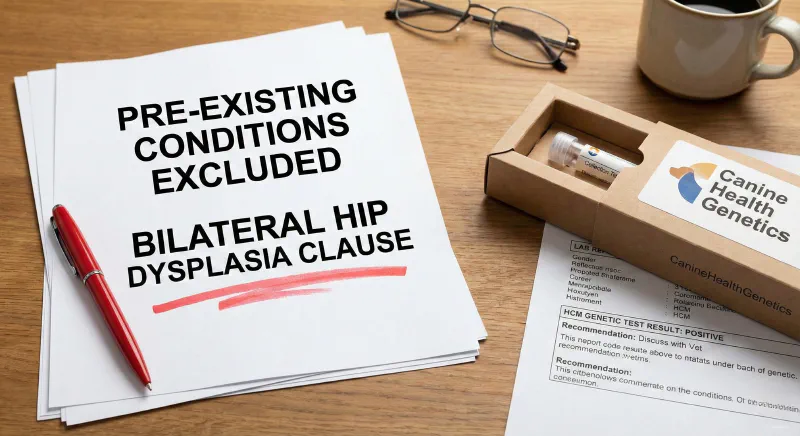

The Exclusion Trap#

Once a veterinarian notes a sign or symptom of a hereditary disease (e.g., a heart murmur, joint laxity, or a limp), that condition is classified as pre-existing and will be permanently excluded from future coverage.

- Actionable Advice: Enroll your Maine Coon kitten as early as possible—ideally before its first veterinary visit or DNA testing, and certainly before its first birthday. This maximizes the chance that conditions like HCM or Hip Dysplasia are not flagged before coverage begins.

- The Waiting Period: Most plans have a mandatory waiting period (e.g., 14 days for illness, 6 months for orthopedic issues). Ensure you are aware of these periods before relying on coverage.

3. Comparing Plan Types#

When selecting a plan, focus on coverage that specifically addresses the needs of a large, long-lived, and genetically predisposed breed.

| Plan Type | Coverage Scope | Suitability for Maine Coons |

|---|---|---|

| Accident & Illness (Comprehensive) | Covers unexpected injuries (broken leg) and illnesses (HCM, cancer, infections). | BEST CHOICE. Essential for covering genetic conditions and emergency surgery. |

| Accident-Only | Covers only injuries (e.g., car accident, falls). | NOT SUITABLE. Does not cover HCM or Hip Dysplasia. |

| Wellness Riders | Optional add-on for routine care (vaccines, dental cleanings). | Optional. Can be beneficial but should not replace comprehensive illness coverage. |

4. Key Questions to Ask Your Provider#

When purchasing a policy, you must confirm coverage specifics relevant to large breeds:

- Hereditary Conditions: Does the policy cover hereditary and chronic conditions (like HCM, chronic kidney disease, diabetes)? (Most comprehensive plans do, provided the condition is not pre-existing).

- Specialist and Diagnostic Fees: Does the plan cover specialist visits (Cardiologist, Orthopedist) and advanced diagnostics (Echocardiograms, CT scans)?

- Bilateral Conditions: If Hip Dysplasia is diagnosed on one hip after enrollment, will the policy cover the other hip if it develops later? (Some policies try to exclude the second hip; seek a plan that covers bilateral conditions if one side is initially covered).

- Lifetime Limits: Does the plan have a per-condition or annual limit that might be easily exceeded by a large orthopedic surgery or long-term cardiac medication?

Conclusion#

Pet insurance is the ultimate protective gear for the Maine Coon, shielding owners from the financial strain associated with the breed’s genetic risks. By understanding the critical importance of early enrollment—before any clinical signs of HCM or Hip Dysplasia emerge—and by choosing a comprehensive, high-limit plan, Maine Coon owners can ensure they prioritize their cat’s health without facing devastating financial choices.

🔗 References & Further Reading#

- Veterinary Economics & Management. Cost Analysis of Managing Feline Hypertrophic Cardiomyopathy (HCM) Long-Term. (Professional breakdown of the long-term veterinary costs associated with feline cardiac disease).

- American Veterinary Society of Animal Behavior (AVSAB). Managing Chronic Pain and Disease in Cats. (Guidance on maintaining quality of life for cats with long-term conditions).

- North American Pet Health Insurance Association (NAPHIA). Guide to Understanding Pet Insurance Coverage. (Consumer resource detailing policy types, exclusions, and financial mechanics).

- TICA Health Committee Report. Financial Planning for Maine Coon Health Risks. (Breed-specific advice on preparing for known orthopedic and cardiac expenses).